Knowing that your money lender is licensed is important to ensure a safe and authentic borrowing experience in Singapore.

A money lender license isn’t just a piece of paper — it’s proof that the lender follows the rules and operates responsibly. Licensed money lenders help create a safer, more transparent borrowing environment for everyone, whether you’re taking a personal loan or a business loan.

Before you borrow, it’s always a good idea to check that your money lender is properly licensed. With so many lenders advertising online and offline, it can be tricky to tell which are licensed money lenders and which are unlicensed money lenders. In 2024 alone, more than $6 million was lost to scammers.

That’s where this guide comes in. We’ll show you the simple steps to confirm if a money lender is licensed, so you can steer clear of scams and shady practices.

By following these tips, you’ll be able to choose a trusted, licensed money lender who plays by the rules set by the Ministry of Law — giving you peace of mind that your loan experience will be safe, fair, and transparent.

Where Do I Find the List of Licensed Money Lenders in Singapore?

Wondering how do you check a money lender’s license? The easiest way to find the list of licensed money lenders in Singapore is by checking the Ministry of Law’s (MinLaw) Registry of Moneylenders.

This is an official website that includes the names and contact details of all licensed money lenders in Singapore. Best of all? This list is updated monthly!

As of 1 October 2025, there are 153 licensed moneylenders operating legally in Singapore.

A huge red flag is if the lender says they’re “not on the list” because of a system error, or claims their company name is different from their brand name; it’s likely they’re unlicensed. Some unscrupulous lenders — also called “Ah Longs” in Singapore — might even post fake licences online, hoping you won’t verify their credentials.

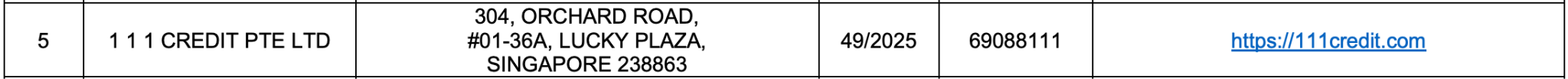

Here’s an example of how a licensed money lender like 111 Credit looks on the MinLaw list.

(Source)

By sticking to licensed money lenders and conducting these quick checks, you can avoid scams and make sure your borrowing experience is safe, fair, and transparent.

What Can a Licensed Money Lender Do and Cannot Do?

Understanding the rules around licensed money lenders helps you borrow safely and avoid illegal or unethical practices.

1. What Licensed Money Lenders Can Do

Licensed money lenders in Singapore are regulated by the Ministry of Law and must follow strict guidelines. They can:

- Offer different types of loans, such as personal loans, business loans, monthly loans and renovation loans.

- Charge interest rates of up to 4% per month on the outstanding loan balance.

- Impose a one-time administrative fee of up to 10% of the principal loan amount.

- Apply late fees of up to $60 per month and late interest of up to 4% per month on overdue amounts.

2. What Licensed Money Lenders Cannot Do

To protect borrowers, there are rules about what lenders are prohibited from doing:

- Advertising via SMS, email, or flyers — they may only advertise in directories, on their official website, or on their business premises. This means that if you receive an SMS or a WhatsApp message promoting a fast loan, they are 100% a scam.

- Retaining your personal documents such as NRIC, passport, or bank card.

- Asking for sensitive information such as Singpass login details or passwords. As a rule of thumb, never share your Singpass login details and passwords with anyone.

- Using threats, harassment, or abusive language to collect payments.

- Changing the loan contract terms without your consent.

- Approving loans without a face-to-face verification meeting at their office. If they promise to transfer the loan money to you without requiring a visit to their shop, it is likely a scam or an unlicensed money lender.

As a borrower, always read the loan contract carefully. Verify the lender’s licence and report any unethical behaviour.

Stop the moment there is something suspicious. Staying informed helps you borrow safely and avoid scams.

Benefits of Choosing a Licensed Money Lender

Why should I choose a licensed money lender instead of a bank? What are the benefits of borrowing from a licensed money lender? Here are the reasons why.

Peace of Mind

You can be assured your money and personal information are safe because licensed lenders adhere to strict rules. Everything is confidential.

Clear and Fair Terms

No hidden fees or confusing contracts. A licensed money lender has to share with you everything from interest rates to repayment terms. All should be transparent.

Tip: Ask the licensed money lender to explain the loan terms in the language you prefer.

Authentic Loans

Legal money lenders help you steer clear of illegal loan sharks and shady practices. They abide by the rules set by MinLaw.

How to Identify Licensed Money Lenders

Before taking out a loan such as a personal loan, conduct a quick check to protect yourself from scams and illegal practices. Here are some ways to verify licensed money lenders.

1. Use the Ministry of Law’s Official List

- Go to the Ministry of Law website and navigate to the “Info for Borrowers” section.

- Download the latest PDF of Licensed Money Lenders in Singapore.

- Compare the lender’s name, contact details, and office address with the list to verify legitimacy.

2. Double-Check in Person or by Contact

- Make a trip to their office. Once you are there, look for their displayed licence certificate and make sure that the address and licence number match the official record.

- Call or email the Registry of Moneylenders to confirm or check the lender’s registration status.

3. Optional: Check CAS Membership

- Being registered with the Credit Association of Singapore (CAS) isn’t required, but it’s a good sign of ethical business practices.

4. Report Anything Suspicious

- If the lender isn’t on the official list or shows unusual behaviour, report it to the Registry of Moneylenders with as much detail as you can.

By taking these precautions, you can borrow confidently from a licensed money lender in Singapore.

Risks of Borrowing From Unlicensed Lenders

Borrowing from unlicensed money lenders carries serious risks and should not be taken lightly.

These unlicensed lenders operate outside the law, so your personal information and finances aren’t protected.

They may charge extremely high interest rates, impose hidden fees, or enforce unfair contract terms, making it easy for borrowers to get trapped in a cycle of debt.

Unlicensed lenders, often called “loan sharks” or “Ah Longs” in Singapore, may employ threats, harassment, or even intimidation tactics to collect money. Examples include calling friends and family to pressure you, showing up at your home or workplace, or spreading false information to coerce repayment. Since they aren’t regulated, you have little recourse if things go wrong.

As mentioned earlier, always borrow from a licensed money lender to ensure a safe and fair borrowing experience. If you are concerned about loan approvals, choose licensed money lenders like 111 Credit which offers friendly staff and a wide range of loan plans for your choosing.

What to Do After Loan Approval

Getting your loan approved from a verified licensed lender is just the first step.

Once you have successfully applied for your loan, what you do afterwards will make a massive difference to your financial health.

1. Review the loan agreement carefully

Even after approval, make sure you read the loan contract thoroughly. Check the loan amount, interest rate, repayment schedule, fees, and all other terms. You don’t want any surprises.

2. Keep copies of all documents

Store digital and physical copies of your loan agreement, repayment receipts, and correspondence with the lender. Having a record can be helpful in case of a dispute or for your own reference.

3. Set up a repayment plan

Plan your repayments carefully to avoid late fees or penalties. Set reminders or automate payments if possible to ensure you never miss a due date.

4. Monitor your loan and finances

Start budgeting! Regularly check your outstanding balance and track your spending to ensure the loan is manageable within your budget.

5. Keep communication open with your lender

If you run into difficulties making a payment, contact your lender early. Understanding licensed money lenders are always ready to discuss and offer guidance on repayment options.

How Do I Raise a Complaint for a Licensed Money Lender

Licensed money lenders in Singapore are required to follow strict rules set by the Ministry of Law. If you believe a lender has breached these regulations, you can file a complaint with the Registry of Moneylenders.

When submitting a complaint, include the lender’s name, contact details, and a detailed account of the incidents, including the specific dates. Attaching supporting documents, such as loan agreements, receipts, or correspondence, can help strengthen your case.

After your complaint is lodged, the Registry will investigate the matter. If they determine that the lender has violated industry rules, their licence will be revoked or they may be fined.

Finding the Right Authorised Money Lender for Yourself

Finding the right legal money lender doesn’t have to be stressful.

To choose your lender, start by doing your homework to stay informed about your loan terms. That is how you can enjoy a safe, transparent, and hassle-free borrowing experience.

Are you seeking a reliable licensed money lender for urgent financial needs? Choose 111 Credit, the licensed money lender in Singapore with over 3,000 Google reviews.

Apply instantly for a personal loan, or if you have any questions, ask away here!